BANKING & FINANCE

Saving money for your emergency fund

by | Oct 15, 2024

For newcomers, it’s not uncommon to face an uncertain financial situation in your first few years. An emergency fund can help you meet unexpected costs, manage expenses while searching for employment, or stay afloat if you face a job loss. Unexpected expenses can arise at any time, anywhere to anyone. Those who are prepared will walk out without bearing too much harm to their financial health. A good way to make sure you can survive a financial crisis is to save money for an emergency fund. This article covers the different types of emergency funds and how you can save money for each fund.

What is an emergency fund?

An emergency fund is a pool of cash that is set aside to be used in the case of an emergency. It should be stored completely away from your checking/saving accounts to ensure that you are not tempted to use it for daily expenses.

The purpose of an emergency fund is to keep you financially secure. When an unexpected expense arrives or you lose your job, this fund will help you cover expenses. Your fund could be used for emergencies such as:

- Urgent medical, dental, or vet bills

- Critical home repairs (i.e. a leaky roof)

- Replacements for an essential major appliance (i.e. refrigerator or stove).

That is why it is important to have at least three to six months of living expenses in your emergency fund. This type of fund is called a traditional emergency fund. However, it is not the only type of emergency fund that will help you.

Different types of emergency funds

Emergency funds are a very important asset to have because they can help you get through a financial crisis without bringing much harm to your financial health. Even so, a traditional emergency fund can take years of saving money to build. Fortunately, there are many types of emergency funds, some of which are easier to save money for. Let’s take a look at three different types of funds:

1. A traditional emergency fund

2. Stash of Cash (having cash on hand)

3. Passive income.

Traditional emergency fund

A traditional emergency fund is the biggest fund on this list. Because of this, it can take years to save up money to build a traditional emergency fund. Generally, a traditional emergency fund should cover three to six months of your income. This means that if you lose your job, you will have enough money in your emergency fund to pay all the bills for several months.

A traditional emergency fund can also be used for things such as health emergencies, auto and home repairs, and any essential need that requires a large amount of money immediately.

Stash of cash

A stash of cash isn’t a big emergency fund and it is easy to save up money for one. This type of emergency fund can come in handy during a natural disaster or a power outage. Basically, you need cash in any situation when you can’t withdraw money from an ATM. Your stash of cash could be anywhere between $500 to $1500. It should be enough to pay your expenses for a week when an ATM is inaccessible.

The biggest concern about keeping money at home is safety. Some argue that it is unsafe to have that much money in your home. This challenge can be overcome by hiding that money in a place that is easily accessible, but hard to find. Just make sure it is nothing too obvious like a money pouch or a wallet.

Most burglaries happen very quickly so hiding your stash of cash in a good place is enough to keep your money hidden. If you are still concerned about safety, you can buy a money safe or locker to hide your money.

Passive income

This third type of emergency fund isn’t even a fund at all. However, during a financial crisis, passive income can prove to be very beneficial. This strategy is also used by countries to avoid a nationwide financial crisis. The main idea here is to diversify your income. Here is how it works:

Most of us have one job that we rely on to pay all of our expenses. But what if you lost that job? How will you pay the bills? To avoid this, you can diversify your income. Simply put, you should find other ways to make money so that you will still have a flow of income that you can rely on to pay the bills if you lose your main job.

You can make passive income in many ways. Some common ways to make passive income are:

- Buying and selling used items on sites like Kijiji or Facebook Marketplace

- Fixing broken items and then reselling them

- Freelancing

- Starting a dropshipping store (e-commerce)

- Creating a course

- Creating a blog.

These are just a few ways to make passive income. There are countless other ways you can make extra money. You can also be a little creative and think of your own way to make money on the side. Overall, your objective should be to diversify your income source so that you can rely on other sources of income during a financial crisis.

Even when there is no emergency, passive income will help you save for your emergency fund and overall, have a higher household income. This will not only help you be financially secure but it will also help you grow financially.

Arrive in Canada Financially Prepared

Building a strong financial foundation is vital to your success. Join this webinar to start your banking journey in Canada on the right foot!

Three strategies to save money for an emergency fund

Six months of living expenses is a lot of money to save up for. For an average family, this can be $30,000 for a traditional emergency fund! As you may have guessed, this type of money can take years to save up for.

An emergency won’t wait for you to make your emergency fund. That is why you should start building your emergency fund as soon as possible.

Let’s look at three effective strategies to save money for an emergency. These strategies will help you save money for a traditional emergency fund because it takes a long time to save money for one.

1. Figure out your expenses

The first step is to figure out how much of your monthly paycheck you must use to pay for necessary expenses. Such expenses include housing expenses, grocery expenses, and car insurance, to name a few. Things like Netflix subscriptions and eating out in restaurants are not included in your necessary expenses.

Once you have figured out your necessary expenses, try to find ways you can reduce those expenses. You can try to find deals at your local grocery store or shop around for cheaper car insurance rates. Here are some ideas that can help you reduce your monthly expenses.

Your next step should be to limit your spending on entertainment or wants. These expenses could include:

- streaming service subscriptions

- vacations, and

- eating out in restaurants.

Of course, I am not recommending that you completely cut down on your entertainment expenses but try to lower them to save money for an emergency fund.

The money you save at the end of the month can go towards your emergency funds, whether it be a traditional one or a stash of cash. You can continue to use this strategy even after you save up for your emergency fund as it will help you grow your savings.

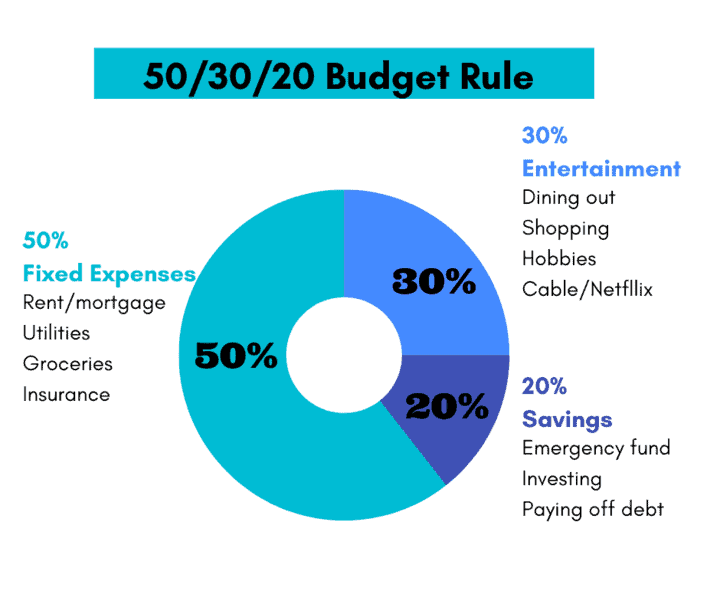

2. Use the 50/30/20 budget rule to save money

If you need something more organized to help you sort out your finances, you can use a common budgeting strategy known as the 50/30/20 budget rule.

This budgeting rule suggests that you use 50% of your income for necessary expenses, 30% for wants, and 20% for financial growth. Financial growth can include things such as:

- Saving

- Investing, and

- Building an emergency fund.

Of course, you can make changes to this rule however you like to make it work for you. In the end, you should put at least 20% of your income towards an emergency fund. At this rate, it would take only 2 ½ years of saving money for a six-month emergency fund. After this time, you can even continue to use this budgeting rule to help yourself grow financially.

3. Take advantage of automated deposits to save money

Automated deposits are a great way of saving money for an emergency fund. If you don’t feel like you are good at managing your finances, why not let automation do the job for you. Even if you are good at managing your finances, automated deposits will still help you stay on track to achieving your emergency fund.

Automated deposits are really effective because they automatically put a portion of your earnings towards your emergency fund. That way, you won’t be tempted to use that part of your income for daily expenses.

Saving money for your emergency fund is an important way to manage financial stress. For newcomers, it’s important to prepare for financial uncertainty as you adjust to life in Canada. With these savings strategies, you’ll be able to manage a money crisis.

For more information about your financial first steps in Canada, visit our banking in Canada resource page. Get the essential information you need to manage your finances in Canada!

Related articles

Read more about your financial first steps in Canada.